Financial services

Accelerate digital financial services with enhanced security and compliance

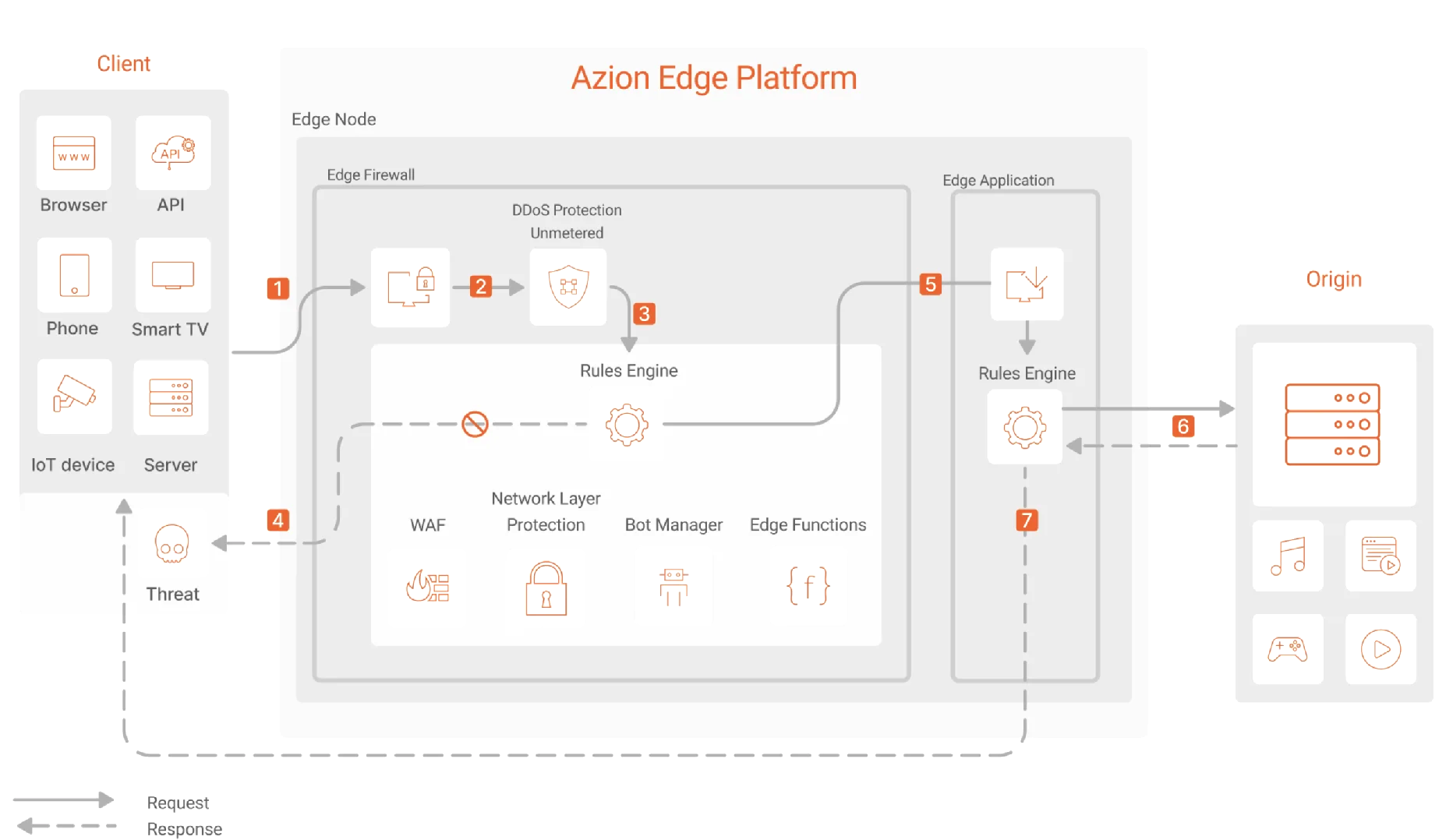

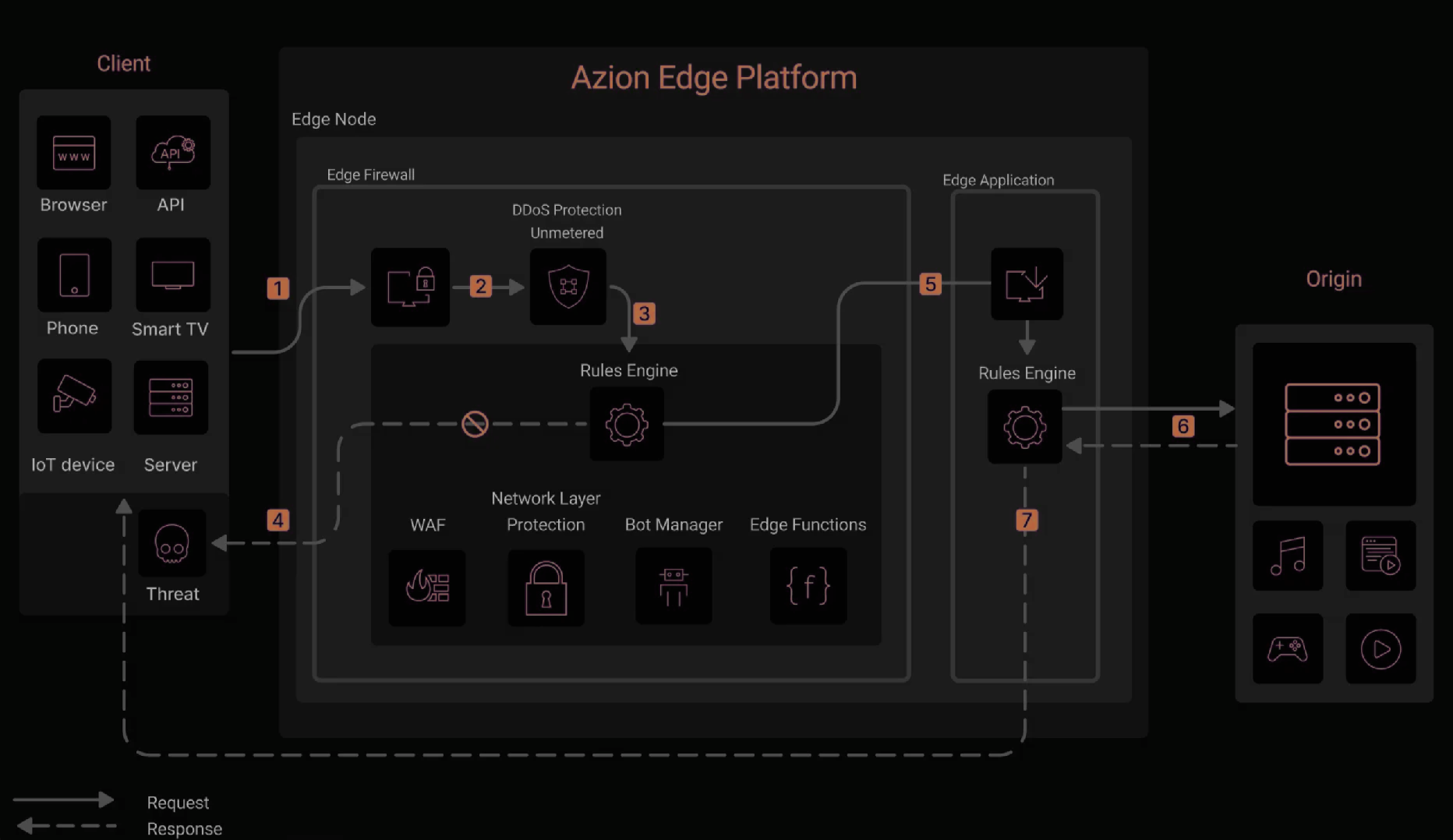

Transform your financial services with Azion Web Platform, delivering continuous availability and scalable performance while reducing operational complexity. Our multi-layered security shields sensitive financial data through real-time protection, and streamlines regulatory compliance across distributed environments with comprehensive audit capabilities.

Operational excellence

Ensures continuous service availability and scalable performance, optimizing application delivery while maintaining high standards across digital channels and reducing operational complexity.

Advanced protection

Strengthens security through multi-layered controls from network to application layers, enabling real-time threat detection and automated response while protecting sensitive financial data.

Continuous compliance

Maintains consistent security policies and controls across distributed environments, streamlining regulatory requirements and ensuring comprehensive audit capabilities for financial operations.

Customers are achieving great results with financial services

Crefisa uses Azion's edge-native solutions to accelerate digital transformation and improve its applications’ and APIs' performance and security.

View success story

FourBank protects its applications and APIs against DDoS attacks by adding a programmable security layer at the edge.

View success story

Contabilizei improves the performance of its accounting platform by 73% and reduces front-end costs by 96% by creating advanced caching rules with Azion.

View success story

Impact at scale

of user requests handled at the edge ensuring high performance

edge functions executed monthly for security controls

reduction in infrastructure complexity

Protect financial applications with advanced security at the edge

Related Products

Secure by design

To ensure customers can use our services with complete confidence, Azion adheres to strict security, availability, and privacy standards.

PCI DSS 4.0

PCI DSS 4.0 certification achieved in 2023, its launch year

SOC 2 Type II

Security and availability for the processing of data close to the end user in the entire Azion network

SOC 3

The SOC 3 report publicly certifies our organizational security

Sign-up and get $300 to use for 12 months.

Access to all products

No credit card required

Credit available to use for 12 months